Lam’s September Quarter: Record Margins, AI Tailwinds—and a China Comedown in 2026

Lam Research delivered record margins on AI-fueled demand while warning China will fade under new curbs. Guidance dips on tariffs and mix, but 2026 growth bets rest on HBM, taller NAND stacks and EUV patterning—where Lam’s etch/deposition moat is deepest.

Lam Research turned in another muscular September quarter, leaning into AI-driven demand while bracing for a tougher China mix next year. Revenue reached roughly $5.3 billion, a company record, with gross margin at 50.6% and operating margin at 35%, also record levels in the post-Novellus era. Non-GAAP EPS of $1.26 topped consensus, capping a run that positions Lam to finish 2025 with three straight quarters above $5 billion in sales.

Beneath the headline numbers, the shape of demand continues to favor Lam’s strengths. Foundry accounted for about 60% of systems revenue, up from the June quarter as leading-edge investments stayed firm. Memory represented roughly 34% (split between NAND ~18% and DRAM ~16%), with DRAM supported by high-bandwidth memory (HBM) builds tied to AI accelerators. Logic/Other was about 6%. Services remained a steady engine: the Customer Support Business Group delivered about $1.8 billion, with record spares and services and robust upgrades, even as Reliant (mature-node) softened.

Geography is the double-edged sword. China rose to ~43% of total revenue in the quarter, reflecting steady spend by multinationals and stronger domestic activity. But the mix is expected to ebb. New U.S. restrictions under the “50% affiliate” rule are already trimming shipments; Lam embeds about a $200 million revenue hit in its December-quarter outlook and pencils in roughly $600 million of headwind for calendar 2026. Management now expects China to be less than 30% of revenue in 2026, as spending by global customers elsewhere accelerates.

That pivot shows up in margins. Lam guided December-quarter revenue to ~$5.2 billion (±$300 million), with gross margin around 48.5% (±1 pt) and operating margin near 33% (±1 pt)—a sequential step down reflecting tariff pressure and a less-favorable regional mix as China normalizes. Still, the setup for next year is constructive: the company sees global wafer-fab equipment (WFE) spending in 2025 coming in slightly above $105 billion, with 2026 shaping up as a growth year across foundry/logic, DRAM and NAND, likely second-half weighted as capacity plans come together. Near term, the first half of 2026 looks flat to slightly up versus the back half of 2025.

AI is the center of gravity. Lam estimates roughly $8 billion of WFE for every $100 billion of incremental data-center capex, a translation that favors deposition and etch intensity at the leading edge. The company argues its served available market as a share of WFE climbs from the low-30s to the high-30s through these technology nodes—a reason it expects to outgrow broader equipment spending over time.

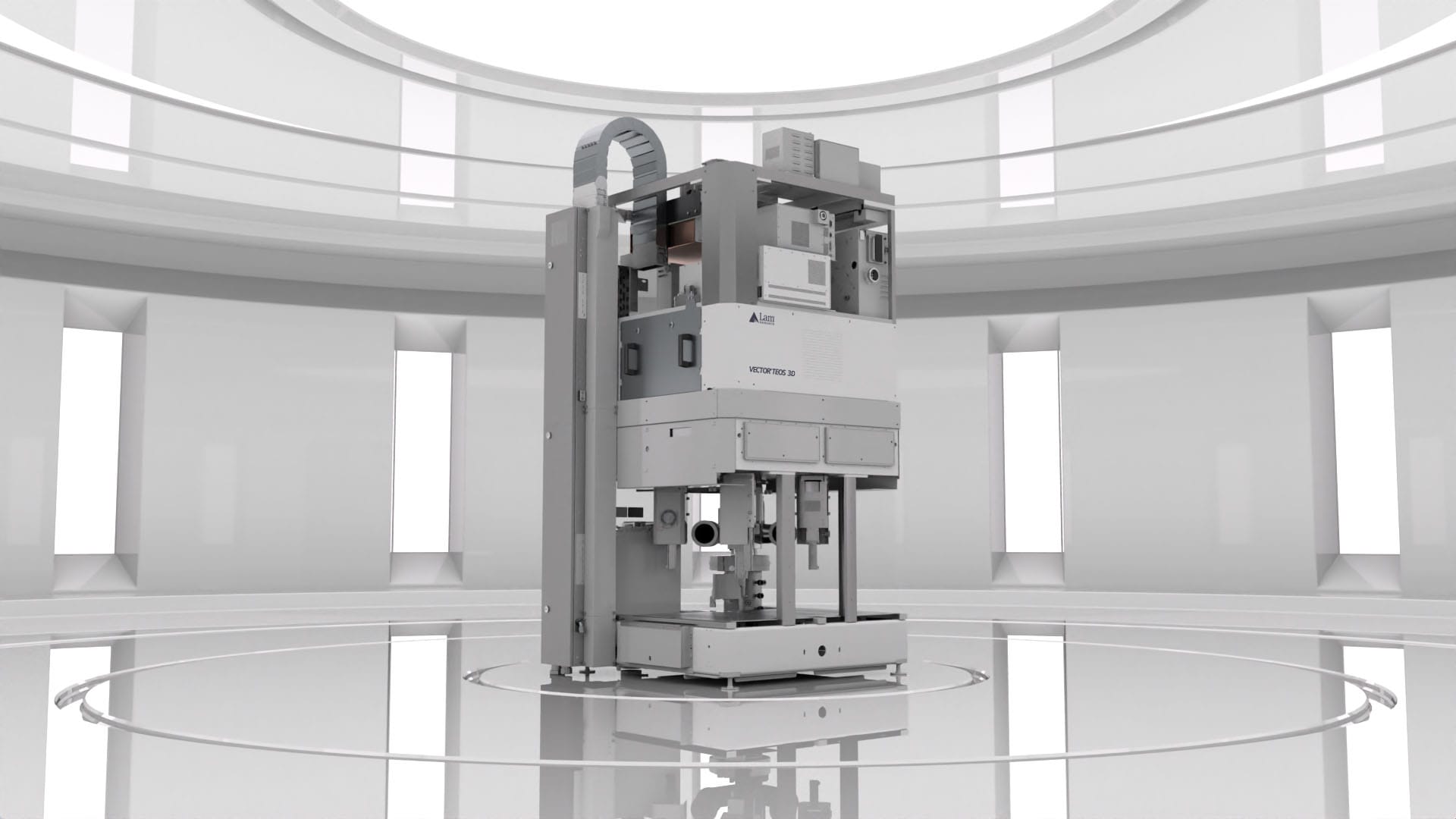

Technology wins back that claim. In NAND, Lam continues to ride the conversion to 200+-layer devices, a multi-year ~$40 billion upgrade cycle that appears to be accelerating as enterprise SSD bit demand surprises to the upside. Its Cryo 3.0 dielectric etch has become a de-facto standard, while Halo Moly ALD is tool-of-record across three nodes at a leading customer—extending word-line leadership as stacks push past 500 layers. The company also highlighted conformal fill at higher temperature on critical high-aspect-ratio steps and low-K single-wafer ALD wins in both foundry/logic and DRAM. On the litho-adjacent front, Aether—Lam’s dry-resist EUV patterning—has demonstrated sub-15nm features with >10% lower EUV dose, and is ramping in HBM high-volume manufacturing, supported by a materials collaboration with JSR. Packaging is a sleeper catalyst: SABRE 3D plating and Syndion etch are benefiting from 2.5D/3D builds today, while Lam seeds panel-level packaging with Kallisto and Phoenix, expecting broader adoption as AI chips sprawl and integration scales.

Cash deployment stayed shareholder-friendly. Lam repurchased about $1.0 billion of stock in the quarter at an average price near $106 (post-split) and raised the dividend to $0.26 per share, with $6.5 billion left on its authorization. Cash and equivalents finished around $6.7 billion; capital spending, aimed at U.S. labs and Asian manufacturing, was modest and focused.

The near-term watch-items are clear: tariff and mix drag on margins, the cadence of China digestion, and physical constraints such as clean-room availability that could pace how fast NAND capacity is added despite stronger bit demand. Yet the broader narrative remains intact. AI is expanding the pie at precisely the technology inflections—etch, deposition, EUV patterning, and advanced packaging—where Lam’s differentiation is deepest. If 2025 was about proving operating leverage, 2026 looks set to test how far those moats can carry growth when China is no longer the wind at Lam’s back.

Author

Investment manager, forged by many market cycles. Learned a lasting lesson: real wealth comes from owning businesses with enduring competitive advantages. At Qmoat.com I share my ideas.